At Daffy, our mission is to help people be more generous, more often. When we launched Daffy, we were proud to be the first major donor-advised fund to let our members both contribute and invest in crypto. As more and more wealth is invested in crypto, we believe it is critical to open up that wealth for charitable causes.

As it turns out, our hypothesis was correct. In just a little over two years, we have seen over $23 million in crypto contributions from thousands of donors on our platform. While our largest crypto contribution has been over $5 million, it might surprise some to learn that our median crypto contribution is just $1,004.

Daffy members who have selected one of our four crypto portfolios have seen significant gains in the past year, all in accounts dedicated to charitable giving. In fact, in the aggregate, Daffy Charitable Fund has seen over $20 million in gains on our platform in the past two years.

With the launch of the new publicly traded Bitcoin ETFs, we see even more opportunity to help our members be more generous. As a result, we have partnered with Bitwise Asset Management to add even more options for members looking to invest part or all of their donor-advised funds in crypto. Bitwise is the premiere crypto asset manager, managing a broad suite of crypto products and providing best-in-class educational tools for investors of all knowledge levels.

New Crypto Portfolio with the Bitwise Bitcoin ETF ✨

As part of our continued aim to bring helpful and innovative features to our members, we are thrilled to offer two globally diversified portfolios for members looking for a prudent, diversified mix of stocks, bonds, and crypto.

These portfolios utilize Vanguard ETFs for low-cost global exposure to stocks and bonds, and Bitwise funds for crypto:

- Crypto - Diversified Conservative: A globally diversified portfolio based on a traditional 60/40 split of stocks and bonds, but then adding a 5% allocation to crypto via Bitwise 10 Crypto Index ($BITW), rebalanced daily. Total expense ratio of 0.17%.*

- Crypto - Diversified Aggressive: A globally diversified portfolio based on an 80/20 split of stocks and bonds, but then adding a 10% allocation to crypto via the new Bitwise Bitcoin ETF ($BITB), rebalanced daily. Total expense ratio of 0.06%.*

We’re proud to be the first major donor-advised fund to integrate the new Bitwise Bitcoin ETF ($BITB) to offer our members low-cost exposure to this exciting new asset class.

More importantly, we believe that offering diversified portfolios that include crypto as an asset class will encourage more people to put money aside for charity and help them grow their potential giving over time.

For a deeper look at these two new portfolios including an analysis of how Bitcoin can benefit a traditional, low-cost diversified portfolio of stocks & bonds, explore our FAQ on this release.

The Benefits of Bitwise Bitcoin ETF for Donor-Advised Funds

The tax-advantaged nature of donor-advised funds and our daily rebalancing makes it an almost perfect platform for adding crypto to a diversified portfolio, and the new low-cost Bitcoin ETF from Bitwise makes this an incredibly efficient way to add exposure.

- Crypto Exposure with Diversification: While Daffy supports pure crypto portfolios, the new ETF makes it much easier to build a diversified and auto-rebalanced portfolio across more traditional asset classes like equities and bonds while still gaining crypto exposure. Historical data confirms that this combination results in a superior risk-adjusted return over time compared to portfolios constructed without crypto exposure.

- Managed by Crypto Specialists: Our partnership with Bitwise ensures that the portfolio is managed by experts in the field of cryptocurrency with a strong track record of managing institutional-class funds based on crypto assets.

- Low Fees: The low-cost structure of the Bitwise Bitcoin ETF enhances accessibility and efficiency for members. As a result, the total expense ratio for the aggressive diversified portfolio is just 0.06%.*

For more information on $BITB, and to read the fund’s prospectus, visit BITBetf.com/welcome.

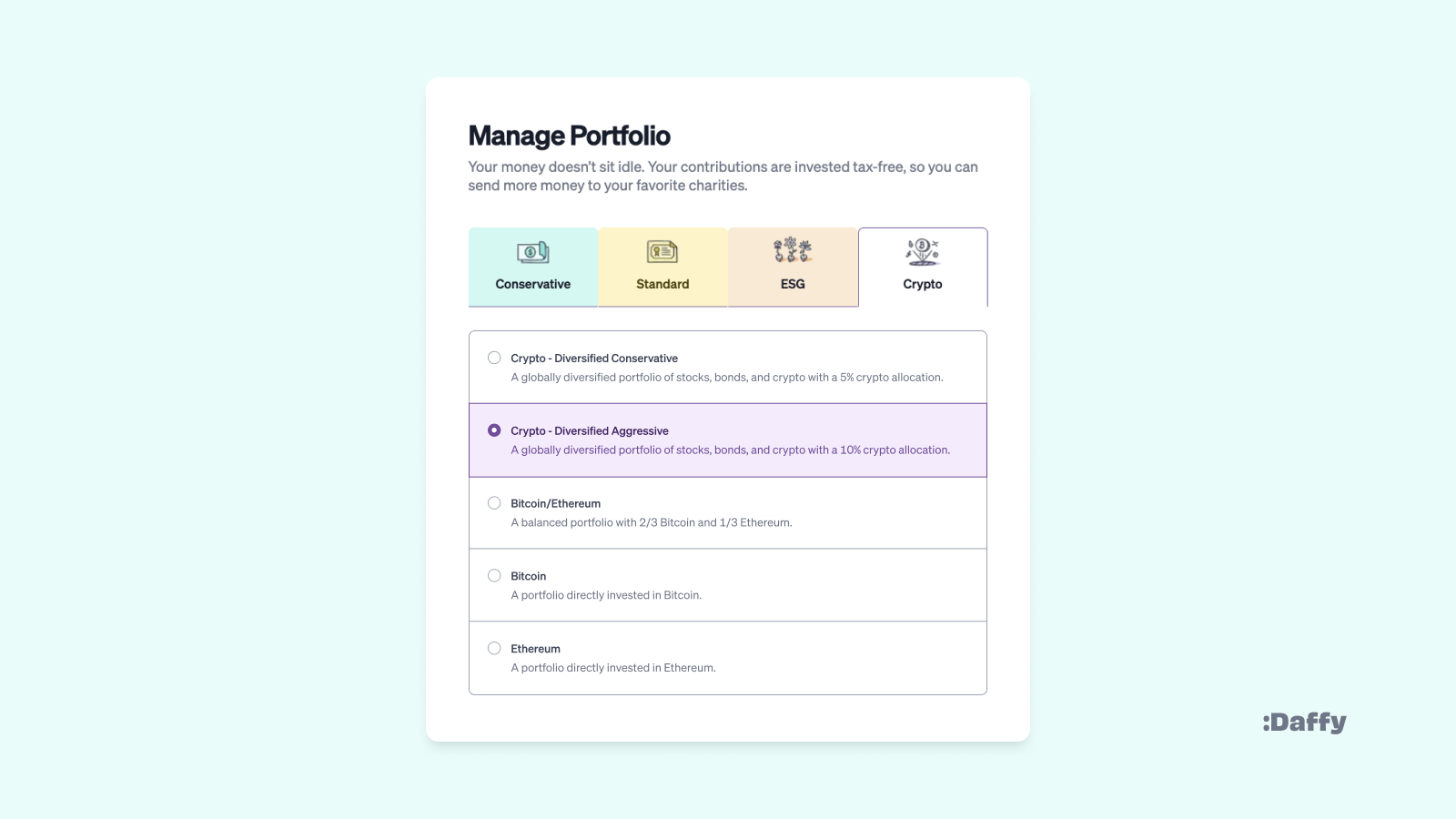

Our Crypto Portfolios

Members can select this Crypto - Diversified Aggressive portfolio alongside our existing crypto portfolios, catering to a spectrum of risk tolerances and investment preferences.

Daffy now offers five portfolio options with crypto exposure, in addition to the ten other portfolios available to our members:

- Crypto - Diversified Conservative: A globally diversified portfolio of stocks, bonds, and crypto with a 5% crypto allocation.

- Crypto - Diversified Aggressive: A globally diversified portfolio of stocks, bonds, and crypto with a 10% crypto allocation.

- Bitcoin/Ethereum: A balanced portfolio with 2/3 Bitcoin and 1/3 Ethereum.

- Bitcoin: A portfolio directly invested in Bitcoin.

- Ethereum: A portfolio directly invested in Ethereum.

Give with Daffy

We hope that by adding these new investment options more people will be inspired to set money aside for charity while harnessing the potential of innovative investment avenues.

So whether you prefer conservative portfolios of cash or bonds, low-cost index funds, ESG-rated investment portfolios, or modern crypto portfolios, you can find the right match for your philanthropic goals.

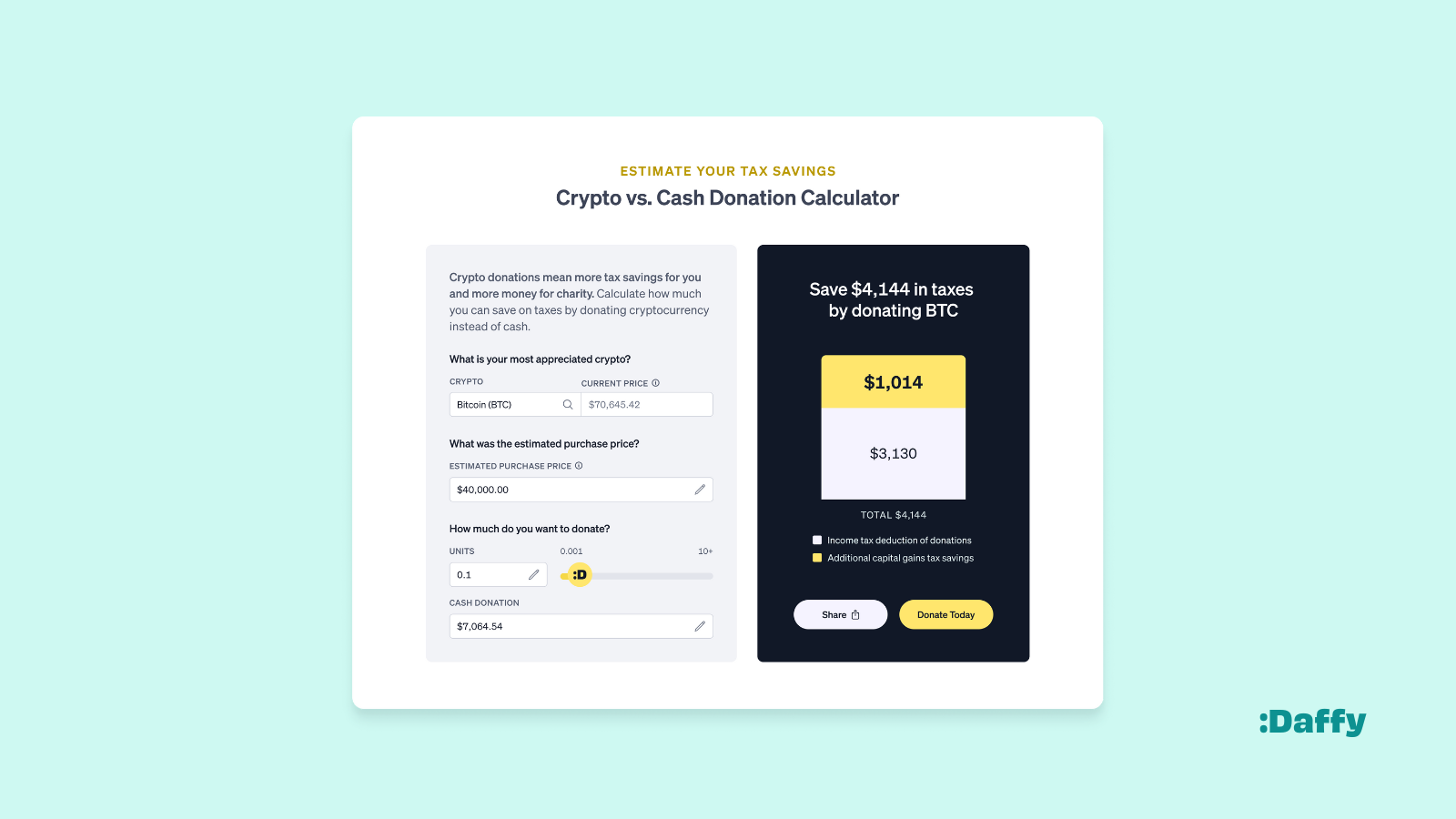

Also if you’ve held crypto for more than a year that’s appreciated, please consider donating those assets. Not only will you get a tax deduction for the full fair market value of the asset, but you will also never have to pay capital gains taxes on the appreciation. Check out our free calculator to estimate the potential savings of donating crypto vs. cash.

Daffy is the Donor-Advised Fund for You™.

*All expense ratios are as of 3/15/2024. Expense ratios are portfolio-weighted and calculated using the publicly disclosed expense ratio for each fund. Daffy portfolios are managed as fully invested in the securities outlined above. However, from time to time portfolios may have a small temporary cash balance for liquidity purposes when managing the inflow of contributions and outflow of donations.