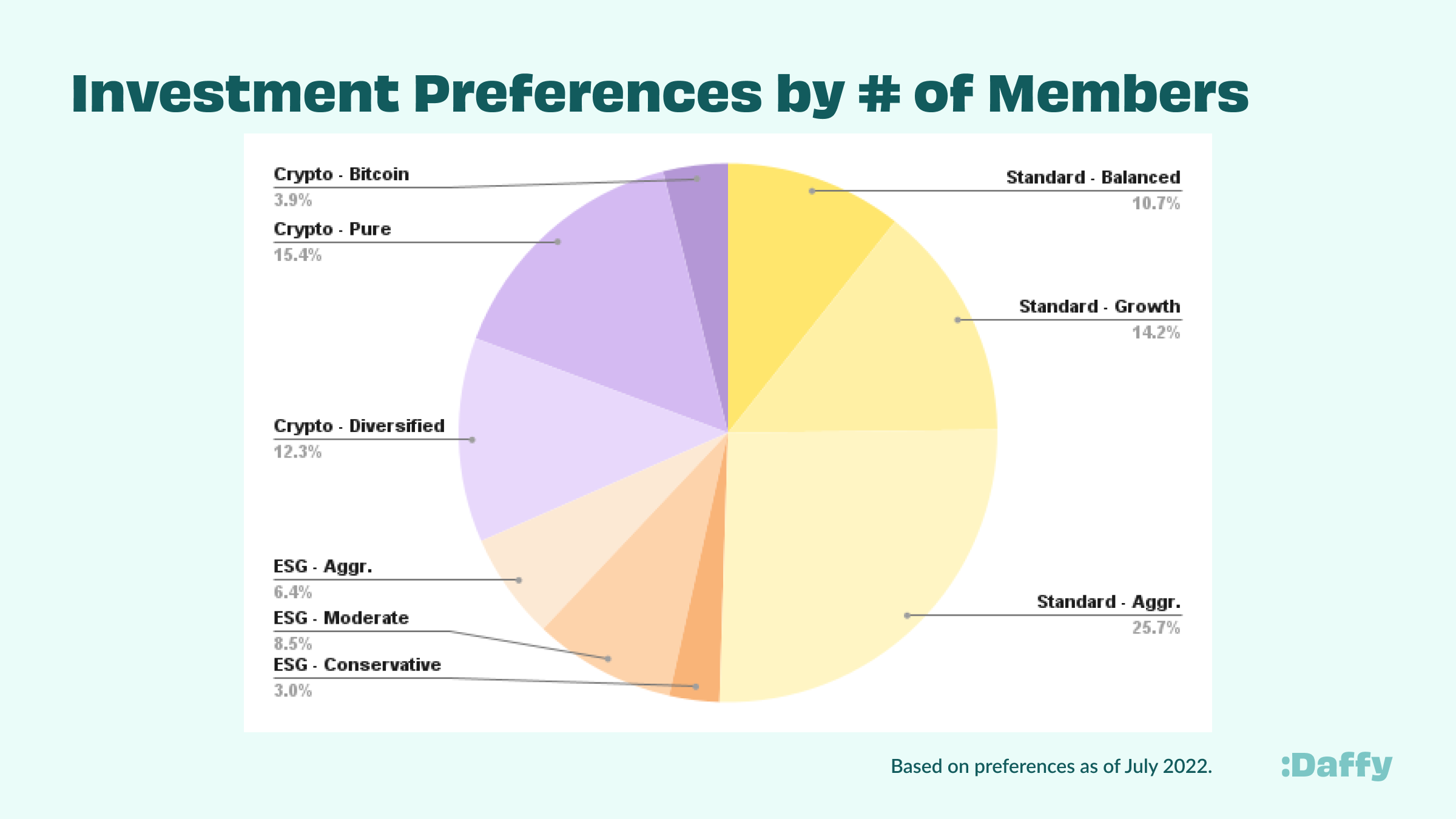

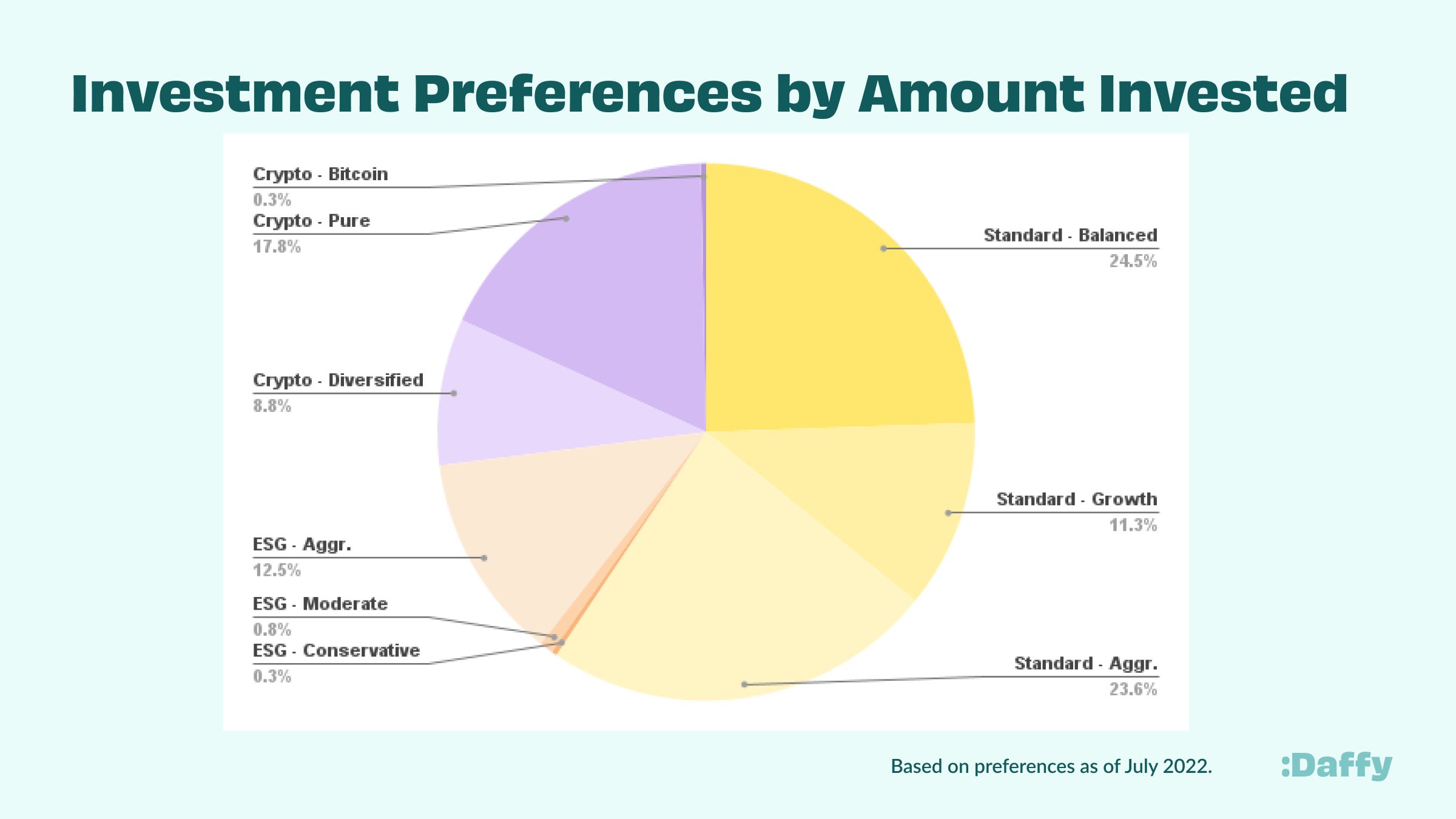

One of the best features of Daffy is the ability for members to contribute their money to a charitable fund, receive a tax deduction, and then invest that money tax-free to grow their impact over time. In fact, many of our members seem to prefer higher-risk portfolios to maximize their potential returns:

Of course, everyone has a different time horizon for charitable giving, and given the market shifts recently, it’s understandable that some members have a desire for less risk in their charitable giving account. In recent weeks we’ve received requests for portfolios that have less market risk than our Standard portfolios.

Today, we’re excited to announce that Daffy has three new Conservative portfolios that will ensure that every member can find a portfolio that is right for their giving plans: a cash portfolio for members who don’t want to take any market risk, and two inflation-protected bond portfolios for members worried about the current high rates of inflation.

Introducing Conservative Portfolios

Members of Daffy can now select across four types of portfolios: Conservative, Standard, ESG, and Crypto. Daffy, unlike most existing donor-advised funds, does not make additional revenue from the investment portfolios held by the fund. As a result, we’re free to construct each portfolio from the investments that best suit our members’ different charitable objectives.

- Cash. The new cash portfolio is designed for members who don’t want to take any market risk with their charitable dollars. The Daffy Cash Portfolio is invested purely in cash with our custodian and FDIC-insured. This portfolio has no expense ratio (0.00%) and pays a small amount of interest (0.01%).

- Short-Term Inflation-Protected Bonds. For members willing to take a small amount of market risk, Daffy now offers a low-cost portfolio of short-term inflation-protected securities from Vanguard (Ticker: VTIP). This fund has a duration of only 2.5 years, and an expense ratio of only 0.04%.

- Long-Term Inflation-Protected Bonds. For members willing to take more market risk in exchange for higher returns, Daffy now offers a low-cost portfolio of inflation-protected securities from Charles Schwab (Ticker: SCHP). This fund has a duration of 7.5 years, and an expense ratio of only 0.04%.

Save. Invest. Give.

At Daffy, our mission is to help people be more generous, more often. We hope that by adding even more investment options for our members that even more people will be encouraged to set aside money regularly, invest that money properly, and then give generously to the organizations and causes that they believe in.

So whether you are looking for a conservative portfolio of cash or bonds, a standard portfolio of low-cost index funds, ESG portfolios that reflect your values, or modern crypto portfolios, you can find the right fit for your contributions at Daffy.

Daffy is the Donor-Advised Fund for You™.