It is possible that there has never been an engine of wealth creation quite like Silicon Valley.

A June 2025 survey of over 3,000 Nvidia employees found that 76-78% of them have a net worth over $1 million, and nearly half have a net worth of over $25 million. Why? It’s not hard to figure it out. Nvidia stock has gone from one of many large technology companies to the most valuable company in the world, all in a matter of a few years.

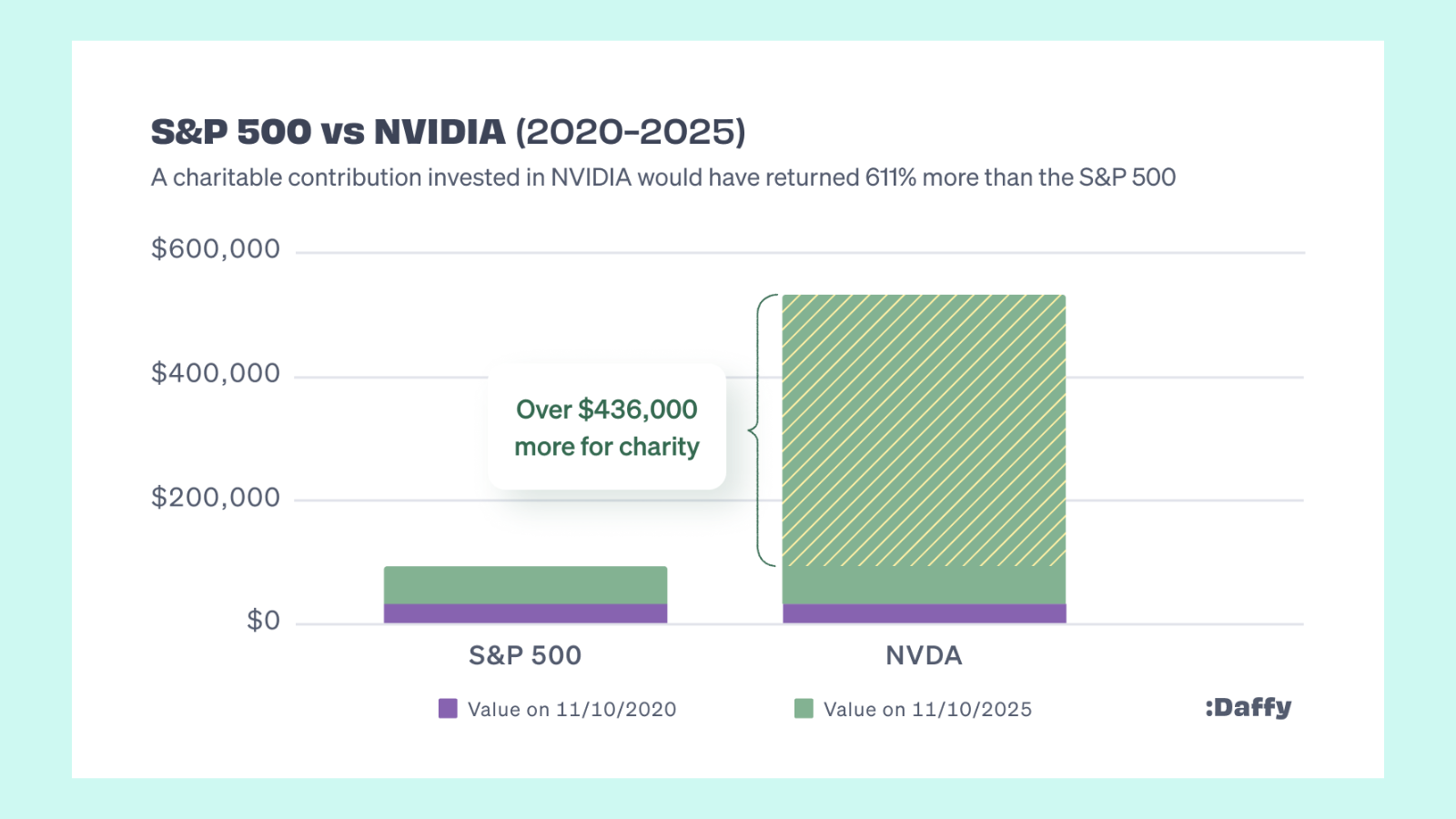

Five years ago, on November 10, 2020, one share of $NVDA was worth $12.73. And as of November 10, 2025, one share of $NVDA is worth $199.05, an eye-popping gain of over 1,464%.

If an Nvidia employee had put aside 2,500 shares of stock for charity five years ago, they would now have over $436,000 to donate. Unfortunately, if they had made that contribution to a donor-advised fund at Fidelity, Schwab, or Vanguard, that stock would have been liquidated immediately. Most of those potential gains would have been lost.

Not anymore.

At Daffy, we pride ourselves on using technology to help people be more generous. Today, we are proud to unveil our latest feature to help all of those employees and investors make the most of their stock donations.

Introducing Custom Liquidation.

Many Daffy members are employees or investors in incredibly successful companies. Now, whenever a Daffy member makes the generous decision to put aside some of their shares for charity, they have unprecedented flexibility to recommend how those shares are held and/or sold in their donor-advised fund.

A Better Way to Donate Stock for Employees & Investors

I’m going to let you in on a little secret… the wealthy have always had this ability.

Oh, you’ll never find it on the websites of companies like Fidelity, Schwab, or Vanguard, but if you are an ultra-high-net-worth individual with a financial advisor and a donor-advised fund over $5 million, the ability to hold stock in your DAF for a period of time was something they would do for you. No technology here really — just a bespoke process executed by teams of financial professionals manually.

At Daffy, we see a much larger opportunity to empower the millions of people who are either employees or successful investors in public companies.

Employees who receive part of their compensation in stock work for years to help build value in their companies. Naturally, it’s harder to donate stock when you believe that your efforts and the efforts of your colleagues will lead to more growth in your stock. With Daffy’s new Custom Liquidation, those objections disappear. You can put aside 100 shares or 100,000, all invested tax-free for the benefit of the charities and causes you care about.

Investors know how hard it can be to part with a stock that has appreciated greatly, despite the significant tax advantages of donating stock to charity. Especially with the end of the tax year approaching, investors can easily be torn between the desire to get a tax deduction immediately versus their continued faith in the future growth of the stock. With Custom Liquidation, Daffy members can now to donate stock when it makes sense to them from a tax perspective, and still reap the benefit of future gains for the charities they support.

Daffy members have always been able to do this with crypto: the platform lets you contribute Bitcoin, Ethereum, or Solana and keep your donor-advised fund invested in those same assets. With Custom Liquidation, Daffy has now extended that same ability to publicly traded stocks and ETFs.

Under the Hood: How Custom Liquidation Works

By default, when you contribute stock to Daffy, like every donor-advised fund, the stock is liquidated almost immediately upon receipt and reinvested in the portfolio assigned to the account. Unfortunately, this can lead people to donate less stock to charity, especially in cases where the donor believes strongly in the future growth potential of that stock.

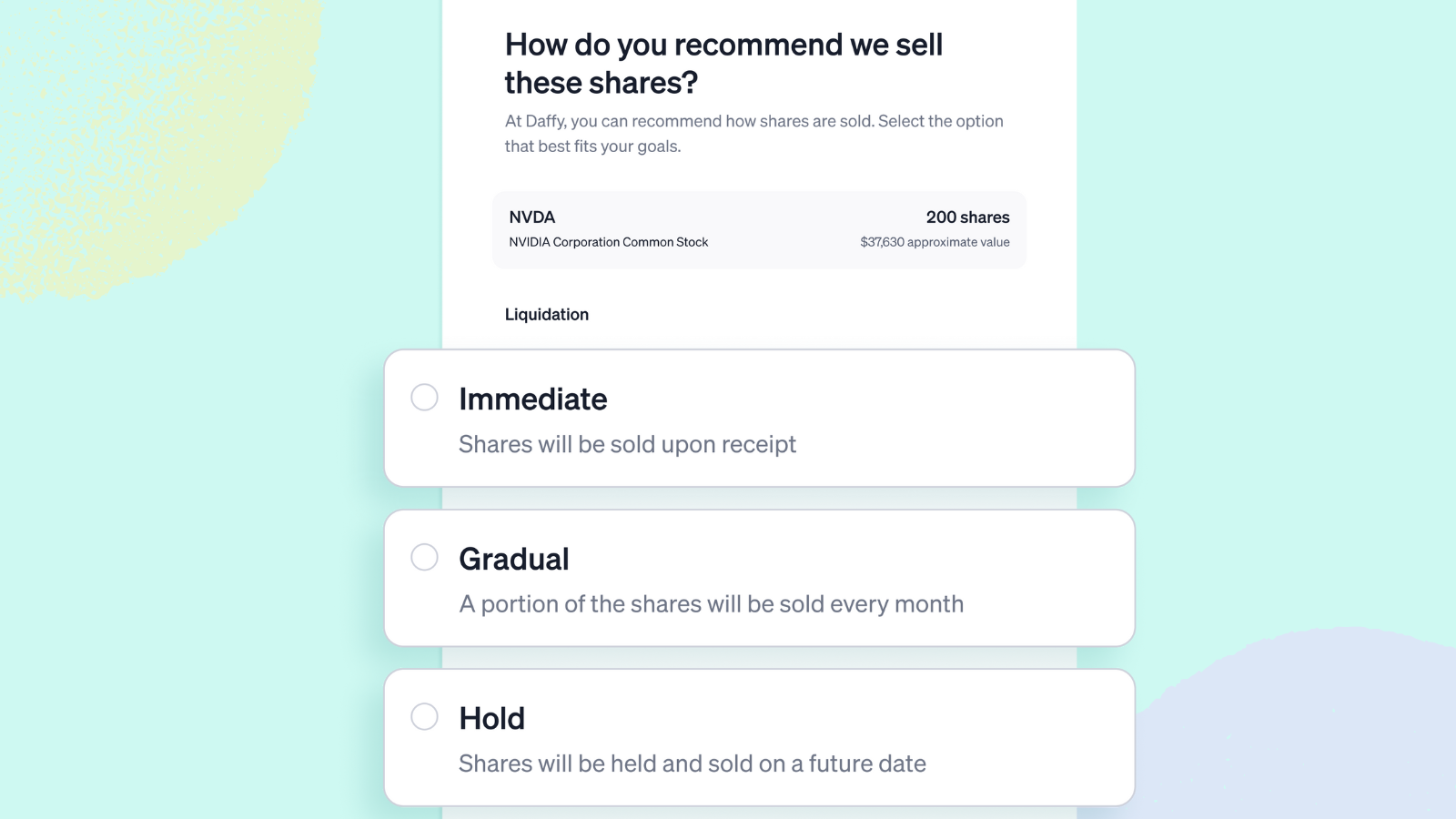

With Custom Liquidation, Daffy now allows members to make a recommendation when they contribute stock on when and how to liquidate the donated securities. Members can recommend that the shares be held for a period of time, sold gradually, or liquidated immediately.

It’s just that simple.

There is no limit to the number of stocks and ETFs you can contribute to your Daffy account, and your liquidation recommendation can be different for each contribution.

Once a security is liquidated, all proceeds are invested into the portfolio assigned to the account, whether it is one of our standard portfolios or a custom portfolio selected from the over 460 different ETFs on our platform.

With Custom Portfolios and Custom Liquidation, Daffy now offers its members more flexibility for their charitable donations than any other donor-advised fund.

Introducing a New Level of Membership: Philanthropist

Custom Liquidation only makes sense for donors looking to put aside large amounts of a single stock for charity. As a result, Daffy is launched a new tier of membership, anchored by this new feature: Philanthropist.

Now, whatever your level of charitable giving, Daffy has a membership designed for you:

- Supporter (Free): No stored balance, just giving

- Contributor ($3/mo): The DAF for everyone. Put money aside every week, month, or year, and set up recurring donations for organizations you care about. Average annual contributions under $25K.

- Family ($5/mo): For households. Add up to 24 members, average annual contributions $25K to $50K.

- Benefactor ($20/mo): For more sophisticated donors funding accounts for multiple years at a time. Custom portfolios. Average annual contributions of $50K to $100K.

- Philanthropist ($40/mo): For members building large, indefinite endowments to fund causes and organizations for the long term. Custom Liquidation. Average annual contributions from $100K to $100M+.

Capital Gains for Charitable Causes

2025 has been a year of outstanding returns for investments including stocks, ETFs, and crypto. But we all know that it hasn’t been an outstanding year for everyone.

Charitable organizations depend on regular support every year. This is why it is so critical to put money aside for charity in good years, so money is available to give in the not-so-good years.

Put some of the shares from your investments or your employer aside for the causes and organizations you care about, with the confidence that the growth from those shares will help fund your donations for years to come.

Custom Liquidation is no longer a secret just for multi-millionaires.

Daffy is the Donor-Advised Fund for You™