Ever since Apple Computer captured the public's imagination by going public in December 1980, Silicon Valley IPOs have become popular events tracked across the world. Last week, millions watched Dylan Field and the Figma team ring the bell for their IPO, one of the largest in history. By the end of the day, Figma stock closed at $115.50 per share, valuing the company at over $67.7 billion.

Figma’s IPO was a huge milestone for the company and its mission to elevate design across organizations. As expected, it was also a huge financial event for the employees, former employees, and investors who helped build the company and platform over the past 13 years.

However, this IPO had another big winner.

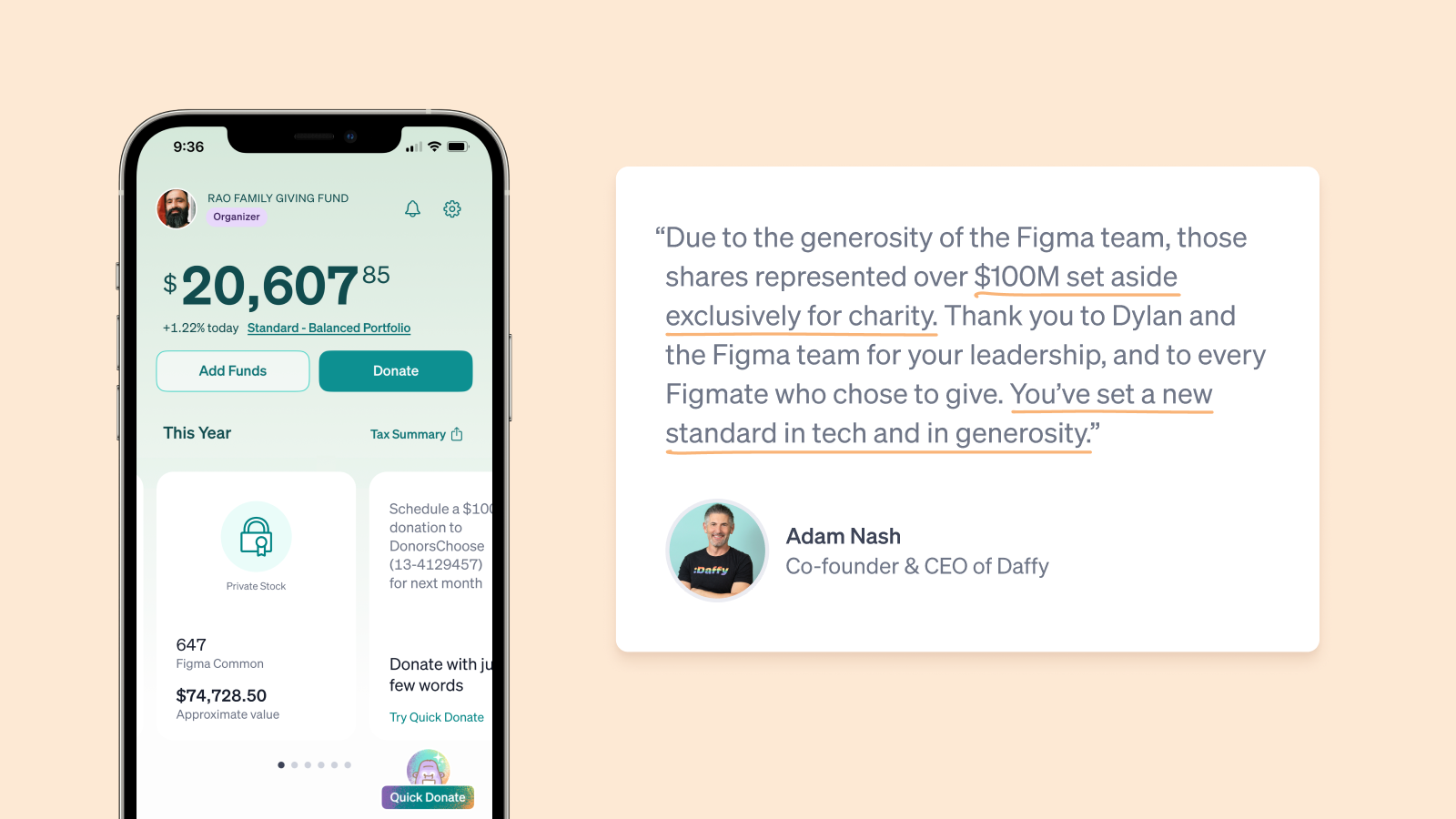

In 2024, Figma employees put aside almost 1 million shares of stock for charity through the Daffy Private Stock Program. At the close of the first day of trading, due to the generosity of the Figma team, those shares represented over $100M set aside exclusively for charity.

Unlocking the Wealth in Private Stock

There is over $2.2 trillion in wealth locked up in US venture-backed private companies, and that number is slated to grow to over $10 trillion in the next decade. Almost a million people work for these companies, and a substantial portion of their compensation is in private stock. It’s too large a number to ignore, especially when it comes to philanthropy.

Unfortunately, too few companies allow their employees to donate private stock, largely because there hasn’t been a platform that supported it. Sure, there are a few donor-advised funds that can support private stock, but they largely handled these transactions as one-off donations for board members and founders. But for most employees? Good luck getting the Board of Directors to approve it.

This is what makes Figma so special, and why Dylan deserves real credit as a founder.

Like many late-stage private companies, Figma held a tender offer last year to allow their employees to sell some stock. But they went a step further.

When Figma partnered with Daffy, they broke new ground. They made it possible for any employee to set aside a portion of their stock for charity. This approach not only encouraged generosity, it made it seamless and tax-efficient. The result? Millions unlocked for important causes.

The Future of Private Stock & Philanthropy is Here

Daffy’s Private Stock Donation Program is now live and available to any late-stage venture-backed private company looking to emulate Figma’s success. With full support for stock administration tools like Morgan Stanley’s Shareworks, Daffy provides the only platform that can scalably open up private stock donations to an entire company.

As more and more companies execute tender offers and other structured secondary sales, they are realizing that allowing participants to donate shares is both a way to support their company values and help employees and investors save millions in taxes.

We believe this will become the standard best practice for every venture-backed company.

Bring Private Stock Donations to Your Company

Getting started is simple. You can learn more about unlocking private stock for charity and supporting your employees through the Daffy Private Stock Donation Program.

If you are the founder, CEO, or CFO at a late-stage venture-backed company, reach out to us. You’ll be shocked at how simple a program like this can be, whether you run it once or annually.

Better yet, if you're an employee at a private company planning a tender offer, or if you want to see this at your workplace, add your name to our interest list. We’ll work with your company's equity operations team to make it happen.

For now, we just want to thank Dylan and the Figma team for your leadership, and to every Figmate who chose to give. You’ve set a new standard for what’s possible in tech and in generosity. We’re honored to be your partner.

Sign up here to help your company become more generous. We’ll handle the rest. 🙏