This piece was originally published on Kiplinger on March 17, 2023.

Rebalancing your portfolio regularly is one of the basic fundamentals of sound long-term investing. The good news for long-term investors is that if you regularly give to charity, there is a tax-efficient way to rebalance your portfolio — the donor-advised fund.

Why rebalance? Over time, higher-risk assets, like stocks, will dominate a portfolio, leading to higher volatility. Without rebalancing, it is too easy for portfolios to drift significantly from the risk-reward balance that is right for your personal financial goals. But if you rebalance too often, you can hurt your long-term returns with higher trading costs and by triggering expensive capital gains taxes.

Some of the best research to date on how to rebalance a multi-asset portfolio has come from Vanguard, which looked at a wide variety of approaches and thresholds. Their conclusion? Most investors would be better off by rebalancing their portfolios once per year, with a 1% or 2% threshold for variation.

Unfortunately, that research did not take into account the donor-advised fund, one of the most useful and rapidly growing types of tax-advantaged accounts available to investors.

The Problem with Rebalancing and Taxes

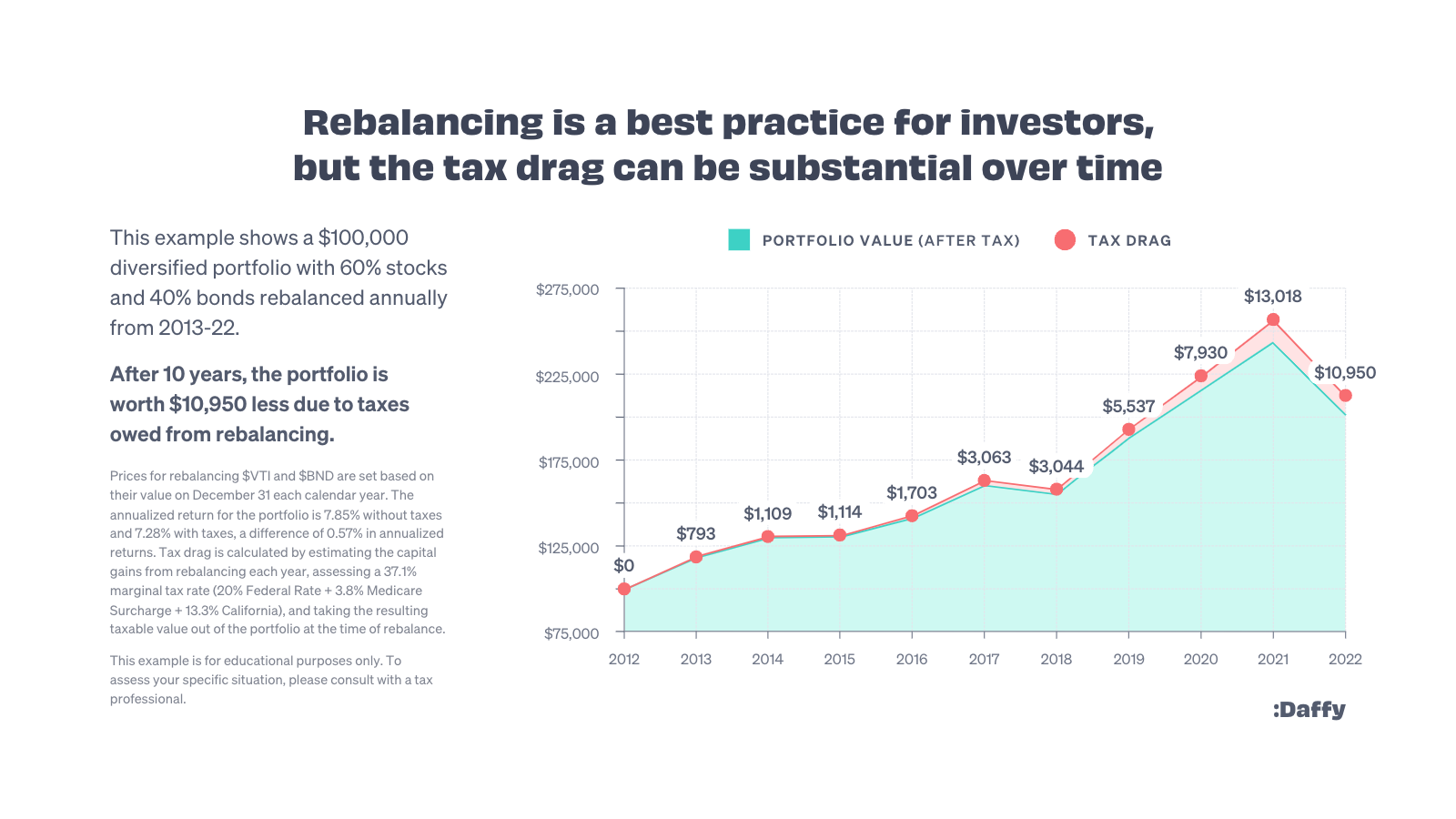

Most people follow a relatively simple process for rebalancing their portfolios, and robo-advisors and target-date funds do this automatically for investors. However, one of the fundamental problems with rebalancing is the drag introduced by triggering capital gains taxes.

By definition, rebalancing a portfolio involves selling assets that have outperformed the overall portfolio and buying assets that have underperformed. This makes sense, as the performance year-to-year of various asset classes is unpredictable, and rebalancing forces investors to periodically “buy low and sell high.”

The problem is that selling assets that have outperformed inevitably leads to realizing capital gains, which means capital gains taxes. In a high-tax state like California, that can mean taxes of up to 37.1% on long-term capital gains (20% federal rate + 3.8% Medicare surcharge + 13.3% California rate).

While this issue is not a problem for tax-deferred accounts like 401(k)s or IRAs, it can seriously impact the performance of a taxable brokerage account.

How to Use Charitable Donations to Rebalance

Between 60 million and 70 million households in the United States donate to charity every year. If you are one of those households, there is a better and more tax-efficient way to rebalance your portfolio and support the charities and causes you care deeply about.

In the traditional method, rebalancing a portfolio involves two sets of transactions. First, you sell off the excess amount of the assets that have outperformed the portfolio. Second, you use the cash to purchase shares of the underperforming assets.

But if you regularly give to charity, you can save taxes by changing the first step of this process.

To understand this new method, you need to recognize only two simple insights:

- When you donate stocks, ETFs, or mutual funds that have long-term capital gains, you get the full income tax deduction (up to 30% of your AGI) for the market value of the securities.

- There is no “wash sale rule” for donating securities.

As a result of these two facts, you can dramatically increase your tax savings every year when you rebalance by donating appreciated shares instead of selling them, and then using the cash that you would have normally donated to charity to purchase the underperforming assets.

Let’s look at a simple example to illustrate. Imagine an investor who has a $100,000 portfolio made up of 60% stocks and 40% bonds, as represented by Vanguard Total Stock Market Index Fund (Ticker: VTI) and Vanguard Total Bond Market Index Fund (Ticker: BND).

This investor has been holding their portfolio for a few years without rebalancing, and in that time period, stocks have outperformed bonds, so the portfolio is now a $120,000 portfolio made up of 70% stocks ($84,000) and 30% bonds ($36,000). To rebalance this portfolio back to the desired 60/40 split, the investor would normally sell $12,000 of VTI and use those funds to purchase $12,000 of BND.

Unfortunately, that would trigger $12,000 of long-term capital gains, which at top rates could mean a $4,452 tax bill for federal and state taxes.

But if this investor normally donates $6,000 per year to charity, they can save half of that tax bill.

Instead of selling $12,000 of VTI, they can donate half of those shares ($6,000) to charity instead. They get the same charitable deduction they would have received for donating cash, and they never trigger those capital gains taxes. Since they did not use the $6,000 in cash they normally donate to charity, they can use that money to buy $6,000 of BND to help rebalance their portfolio, saving up to $2,262 in taxes.

That’s a huge number. $2,262 is a 1.9% drag on a $120,000 portfolio. Think of how many investors work diligently to lower their investment expenses by even 0.5%, and these annual savings could be several times bigger!

Donor-Advised Funds Make This Simple

This sounds too good to be true, so if you are looking for a catch, there are a couple. First, most charities do not accept securities donations. In fact, out of the over 1.7 million registered charities in the U.S., only a few thousand accept securities. Second, you may want to spread out your charitable donations to organizations over months or even years.

Fortunately, donor-advised funds solve both of these problems. A good donor-advised fund will accept securities donations and let you invest the proceeds of that donation tax-free until you are ready to recommend a grant to a specific charity.

Donor-advised funds used to have high minimum balances and even higher fees, but there are now modern, low-cost options, like daffy.org, which charge as little as $3 per month.

So rest assured. You no longer have to choose between sound long-term investing and lower taxes. By taking advantage of the ability to donate your appreciated securities, you can now rebalance your portfolio annually and save money on taxes.

Note: The information provided is for educational purposes only and should not be considered investment advice or recommendations, does not constitute a solicitation to buy or sell securities, and should not be considered specific legal investment or tax advice. To assess your specific situation, please consult with a tax and/or investment professional.