When Clay Christensen published “The Innovator’s Dilemma” in 1997, he changed strategic thinking in Silicon Valley forever. One of his key insights was that the most transformative innovations rarely look serious at first. They arrive as “toys,” easily dismissed by incumbents focused on protecting what already works. By the time those incumbents realize the threat is real, it is usually too late.

That idea became canonical wisdom that, when it comes to innovation, “the next big thing will start out looking like a toy.”

When Daffy launched a little over four years ago, it may have looked like a toy to much of philanthropy. We focused on a simple idea: reinventing the donor-advised fund for the rest of us. Most incumbents long ago decided to chase dollars by optimizing their platforms around sales and service instead of design and technology. After all, they were chasing assets, focused solely on the wealthy.

At Daffy, we launched with a simple mission to help people be more generous, more often. We focused on making it simple for people to put aside a few dollars for charity every month, and make recurring donations to the charities they cared most about.

It may be hard to believe, but after an incredible 2025, Daffy is now one of the Top 10 Donor-Advised Funds in the U.S., out of more than 1,400 providers. Daffy now has over 16,000 member accounts, placing it ahead of DAF providers such as Bank of America, Goldman Sachs, T. Rowe Price, and Raymond James—all of which launched their platforms in the early 2000s.

At launch, Daffy stood out for its unique flat-rate membership pricing. Today, it stands out for a huge number of innovative features that even the largest incumbents can’t match: native crypto, family plans, matching campaigns, private stock donations, custom portfolios, and custom liquidation. Not surprisingly, more and more people are moving their DAFs to Daffy.

Daffy may have started as a simple donor-advised fund for the rest of us, but in 2025, it clearly became the donor-advised fund for everyone.

2025: A Breakthrough Year for Daffy

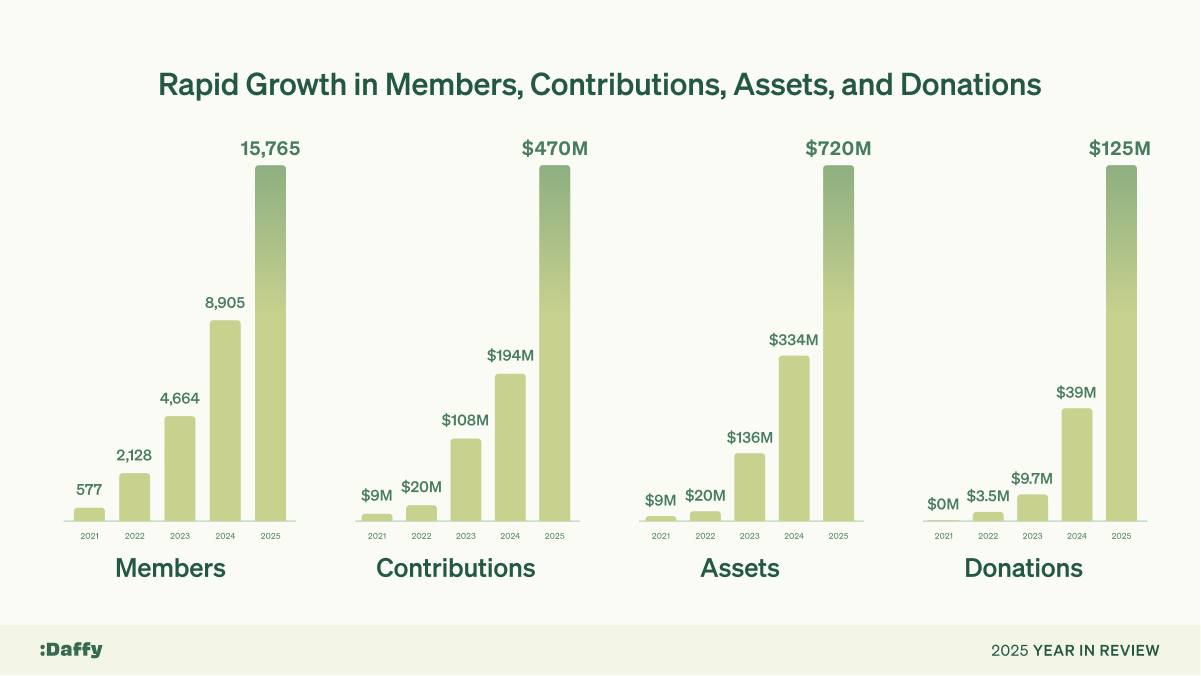

2025 was an unprecedented year for Daffy, and it came across in every metric:

- Membership: Daffy closed 2025 with over 15,700 unique DAF accounts

- Contributions: Daffy received over $470 million put aside for charity

- Assets: Daffy now holds over $720 million in charitable assets

- Donations: Daffy distributed over $125 million in donations to charities

Each of these numbers tells an exciting story, so let’s walk through each of them as we dive deeper into what made 2025 a breakthrough year for Daffy.

Membership: Daffy is One of the Top 10 DAFs in the United States

Donor-advised funds originated in the United States almost 100 years ago, in 1931. There are now 1,485 donor-advised fund providers across the United States¹, most of which are small and cater to local communities. The largest are affiliated with giant brokerages and banks, most of which launched their DAFs in the 1990s.

As of January 2026, Daffy has now become one of the Top 10 DAFs in the entire United States, with over 16,000 unique funds.² As Casey Kasem used to say, we’re #10 with a bullet.

Rankings based on account totals from The Annual DAF Report 2025 (Donor-Advised Fund Research Collaborative) and 2025 estimated projections for other providers derived from their 2022–2024 CAGR. Daffy’s ranking is based on data and estimates through January 2026.

It’s incredible to see a new platform, like Daffy, ahead of some of the most respected financial institutions like Bank of America, Goldman Sachs, T. Rowe Price, and Raymond James.

DAFs continue to grow in popularity. According to the DAF Research Collaborative's 2025 Annual DAF Report, donor-advised funds grew 18% year over year across the industry.

In 2025, Daffy grew over four times faster than the industry average.

The key to the rapid growth? Daffy was designed and built for everyone. Other donor-advised funds have far more in assets, but a shockingly small number of donors. For example, Silicon Valley Community Foundation is a wonderful organization that stewards over $9.5 billion in charitable assets, but from a little over 1,000 donors.³

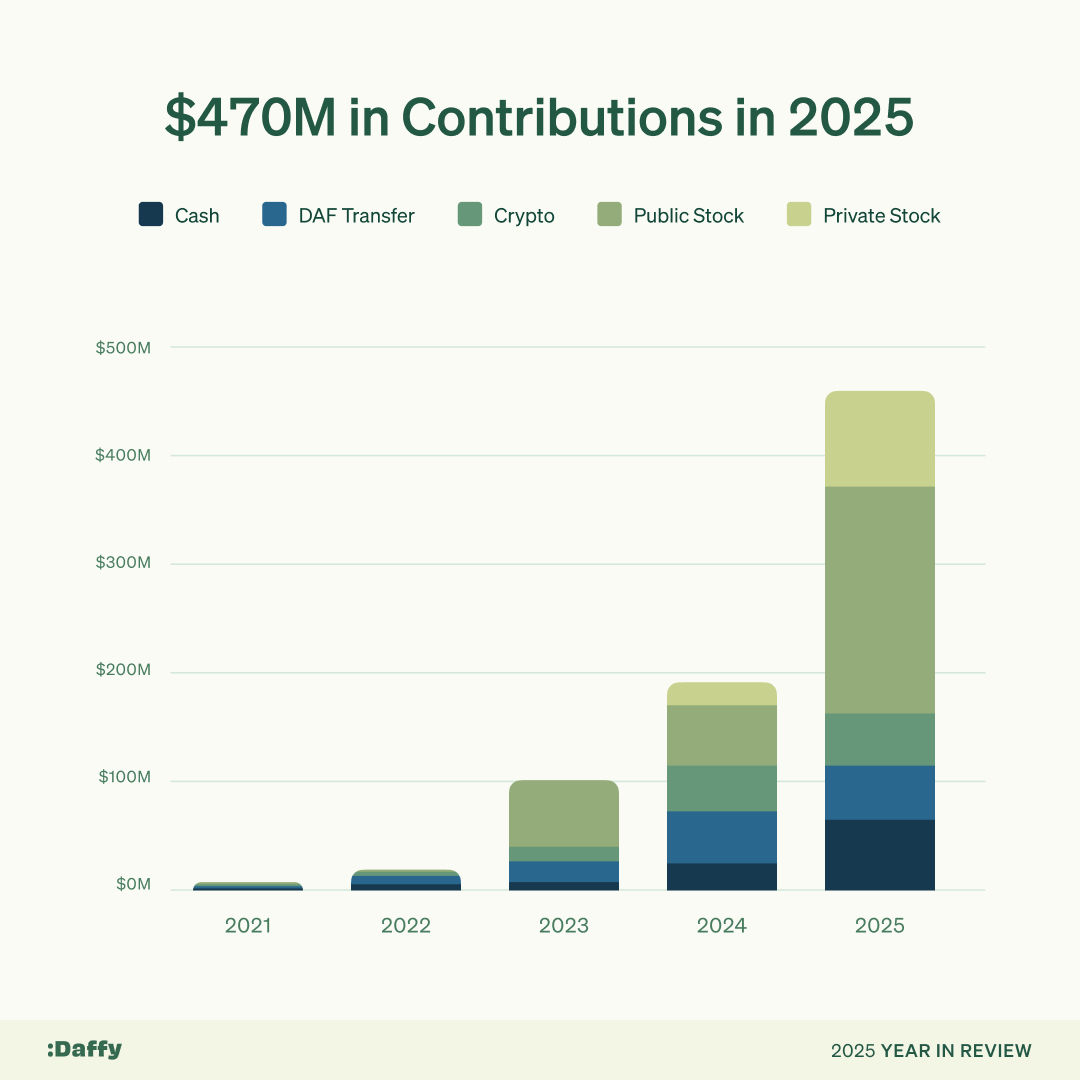

Contributions: 2025 Was All About Private & Public Stock

Lexus may deserve the credit for dubbing the holidays as “A December to Remember,” but for Daffy, December 2025 represented an unexpected boom in generosity.

In all of 2024, Daffy members set aside approximately $194 million for charity. In December 2025 alone, Daffy members contributed over $200 million. That’s right, in just one month Daffy members eclipsed all of their contributions for the entirety of the previous year.

What was the final total? In 2025, Daffy members set aside over $470 million for charity, more than 2.2 times the prior year.

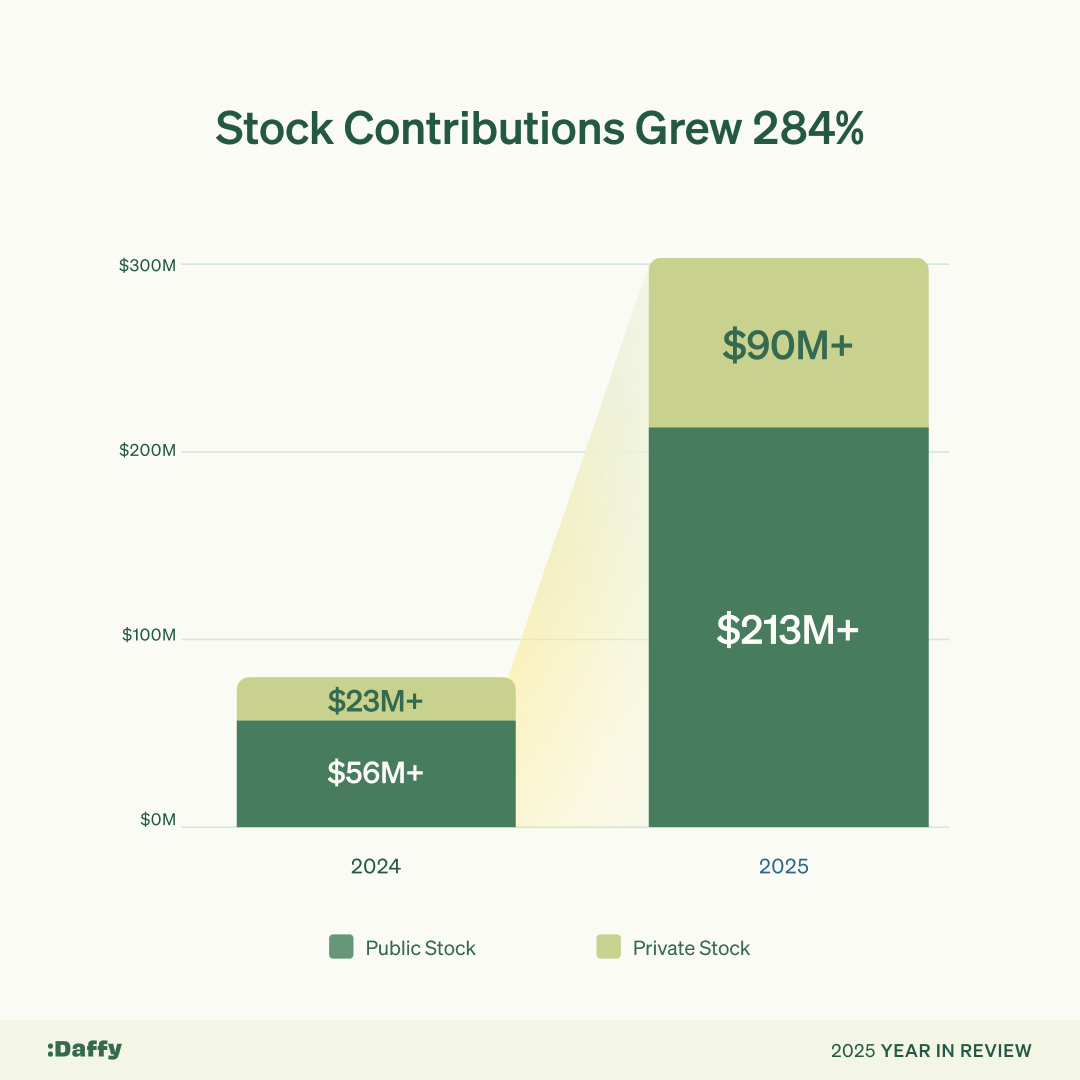

Daffy saw growth in all different types of charitable contributions, including cash, stock, mutual funds, ETFs, crypto, and private stock. However, it’s very clear from the data that the primary driver of 2025 growth was stock. As awareness grows around the tax benefits of donating appreciated stock, Daffy members contributed over $213 million in public stock in 2025.

More than a few eyebrows were raised in 2024 when Daffy launched support for private stock contributions. But as more wealth is created in startups and private companies, our Private Stock Donation Program helps unlock giving that historically was reserved only for founders and executives. In 2025, members of our Daffy for Work platform contributed over $90 million in private stock.

We continue to believe that, over the next decade, every private company that does a tender offer or structured secondary offering will add a private stock donation program. It costs the company nothing, helps employees with taxes, and could free up billions of dollars for charitable causes.

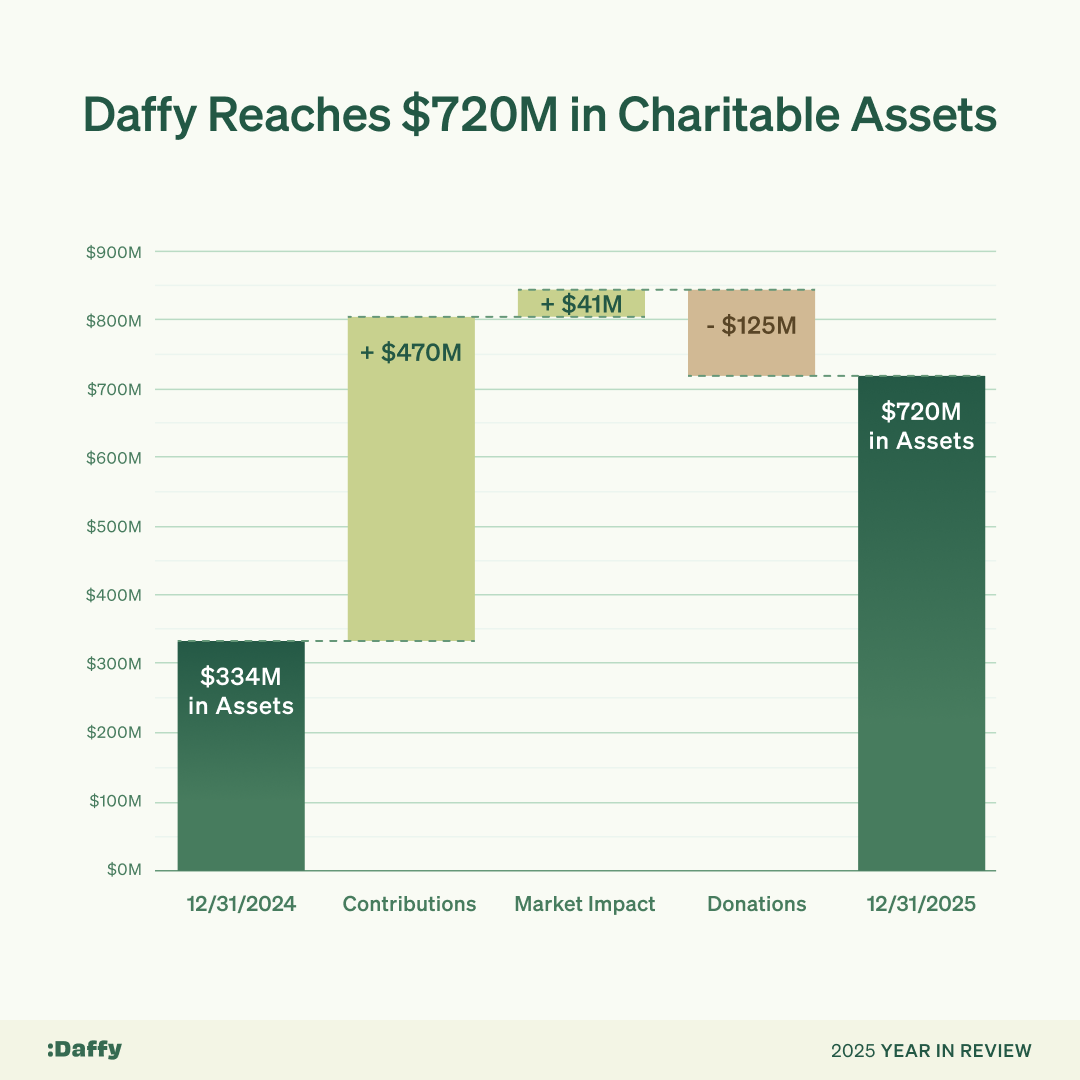

Assets: Daffy crosses $720M in Charitable Assets

Daffy has never been motivated by growing assets. In fact, our unique and disruptive flat-rate pricing with no asset-based fees is designed to encourage our members to make donations. Our original goal for 2025 was to reach $475 million in assets by the end of the year.

Despite more than tripling donations from 2024 to 2025, Daffy ended 2025 with over $720 million in charitable assets.

How is that possible? Most of the variance can be explained by two simple factors: a massive increase in stock contributions (public & private) and strong investment performance. Daffy members contributed 284% more in appreciated stock compared to 2024, and investment performance added $41 million to charitable assets.

Over the past four years, tax-free investment growth has generated more than $100 million in additional charitable funds. This highlights one of the most valuable aspects of the donor-advised fund. It encourages people to set money aside for charity when it’s convenient, have those funds invested tax-free, and support the organizations they care about in a more consistent and long-term way.

Daffy also gives members the flexibility to recommend how DAF assets are invested. Members can choose from 17 pre-approved portfolios, recommend a custom portfolio built from more than 500 pre-approved ETFs, and through Custom Liquidation, even recommend holding individual stocks for a period of time before they are sold.

Donations: Daffy Makes People More Generous Over Time

We couldn’t be prouder to see Daffy distribute over $125 million in donations in 2025, more than triple what we distributed in 2024.

Daffy is built from the ground up to encourage ongoing, long-term giving. More than 45% of donations are recurring, and recurring donations are growing faster than one-time donations.

That consistency shows up across every level of giving. In 2025, our largest donation was over $5 million, while our median donation continues to be $100. Daffy works equally well for people who have a few hundred dollars to give as well as people who are donating millions.

The DAF Research Collaborative’s 2025 Annual DAF Report shows an average donation payout rate of 25%. In 2025, Daffy more than doubled that, with a payout rate exceeding 55%. In other words, for every dollar that Daffy members set aside in 2024, more than half was distributed to charity in 2025.

But the most meaningful shift in 2025 wasn’t scale. It was behavior.

From the start, Daffy believed that thoughtfully designed software could help people be more generous by making generosity easier to plan, easier to maintain, and easier to act upon at any time. There is even academic research that confirms the idea.

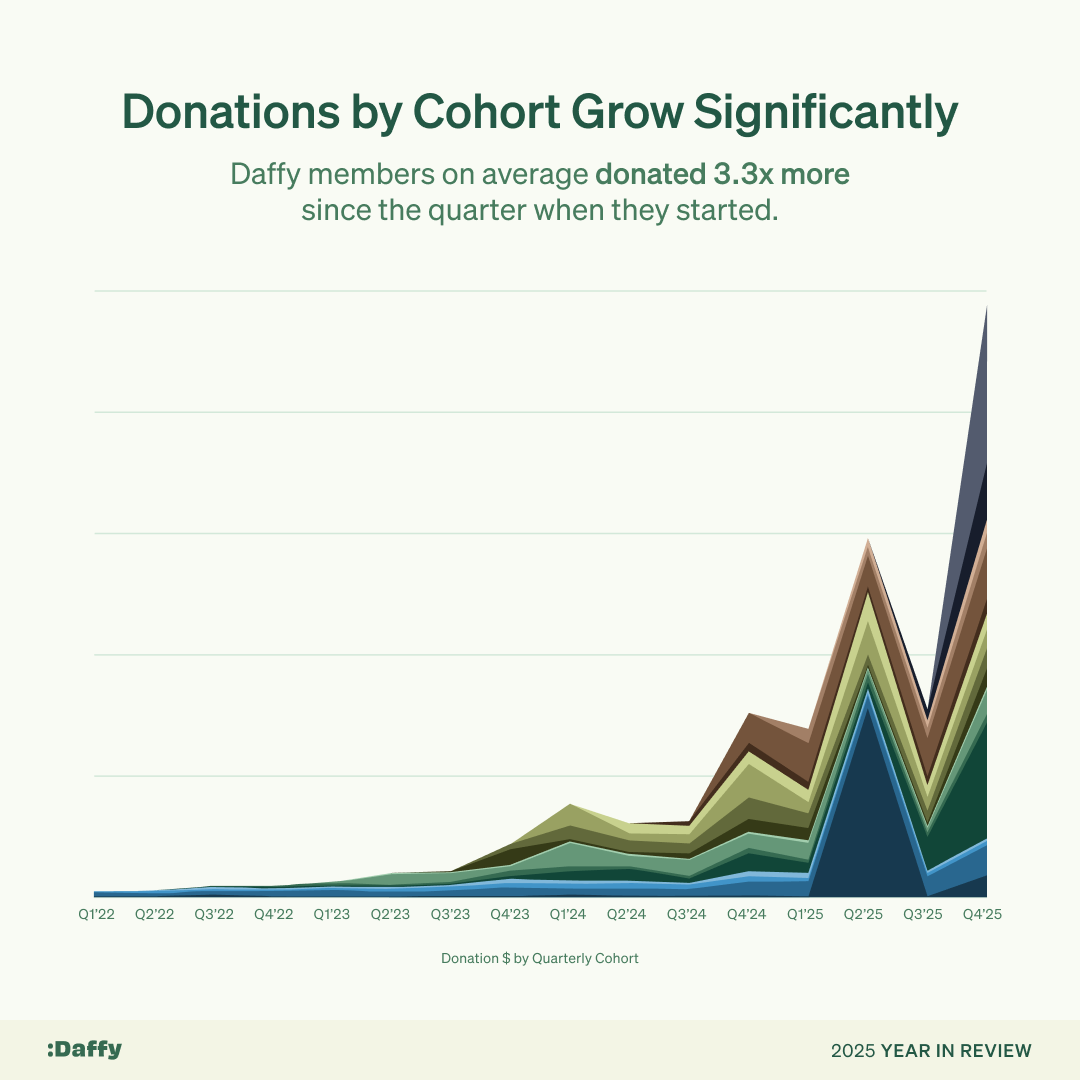

When we look at Daffy members by quarterly cohort, tracking how people give starting from the quarter they join, we see the same pattern repeat, again and again. Members don’t just join Daffy and give the same amount. Across every quarterly cohort since Q1 2022, Daffy members donated an average of 3.3x more since the quarter when they started.

Whether someone sets aside a few hundred dollars or a few million, the outcome is the same: Daffy helps people be more generous, more often.

Daffy is the Donor-Advised Fund for You™

When we launched in September 2021, our focus was clear: the 50-60 million households who give to charity every year. If fintech can help people spend better, save better, and invest better, why can’t those same technologies and techniques be used to help people give better. We launched with extremely low minimums and pricing, to encourage everyone to put something aside for charity.

Fun fact: we were so focused on this neglected audience that we didn’t even launch with a feature to let people transfer donor-advised fund assets from other providers! We figured the wealthy had enough solutions on the market already.

Since launch, Daffy has received more than $125 million in DAF transfers, as people move their charitable funds from legacy providers to a platform built with greater flexibility, more features, and lower fees. Our median DAF transfer is about $10,000, but we regularly receive DAF transfers over $1 million.

We’re grateful to every member who trusted Daffy with their generosity in 2025. This progress is only possible because you’ve committed to setting money aside for charity and trusted us to keep building a better donor-advised fund.

If you haven’t tried Daffy yet, make 2026 the year you do, and support the organizations and causes that matter most to you and your family.

Daffy is The Donor-Advised Fund for You™

Footnotes

All Daffy figures in our 2025 Year in Review are based on initial unaudited results from 1/1/2025 to 12/31/2025. Final audited financials will be available in our 2025 Form 990 later this year. Audited financials from 2021, 2022, 2023, and 2024 are available upon request.

- Heist, H. D., Vance-McMullen, D., Williams, J., Shaker, G. G., & Sumsion, R. M. (2025). The Annual DAF Report 2025. Donor-Advised Fund Research Collaborative. https://doi.org/10.4087/XUGU3656

- Rankings based on account totals from The Annual DAF Report 2025 (Donor-Advised Fund Research Collaborative) and 2025 estimated projections for other providers derived from their 2022–2024 CAGR. Daffy’s ranking is based on data and estimates through January 2026.

- Silicon Valley Community Foundation data from The Annual DAF Report 2025.