A common question we hear from people looking to give back to charity more regularly is “How much should I give to charity each year?” The truth is there is no universal, one-size-fits-all answer. However, if you’d like to be giving more, we believe that just like any other financial goal, such as saving for a down payment on a house, paying off student loans, or building up emergency savings, setting an annual giving goal is a good first step.

“Setting an annual giving goal made it really easy to get me involved in donating more regularly rather than waiting for an organization to send me something in the mail. It just made it simple and it made me more involved in giving, whereas usually I would walk away and say, oh, I don't have that in my budget. But I do, giving is a part of my budget now,” Kelly McConnell.

So if you’re now wondering, “How do I set a giving goal that right’s for me?” or “How much should I give to charity this year?” here are four ways to help you determine an amount that’s right for you.

1. Give within your means—and incorporate it into your financial budget

Before giving to others, it's important to consider your own financial situation and prioritize your own financial needs. By giving within your means, you can ensure you're donating an amount that you can afford without causing financial strain or stress.

As Daffy member Jared Carr puts it:

“It's not about being frugal. It's about creating a margin in our lives for generosity. And for me, that’s living within your means, taking care of your debt, and still valuing things that are important to us, like food and travel…But it’s about just dialing in your finances and adding giving to your budget.”

By making charitable giving part of your financial planning, you can help establish a sustainable giving habit, as you're able to give consistently without sacrificing your own financial stability.

For instance, many of our Daffy members start by setting aside as little as $10 each week or $25 per month.

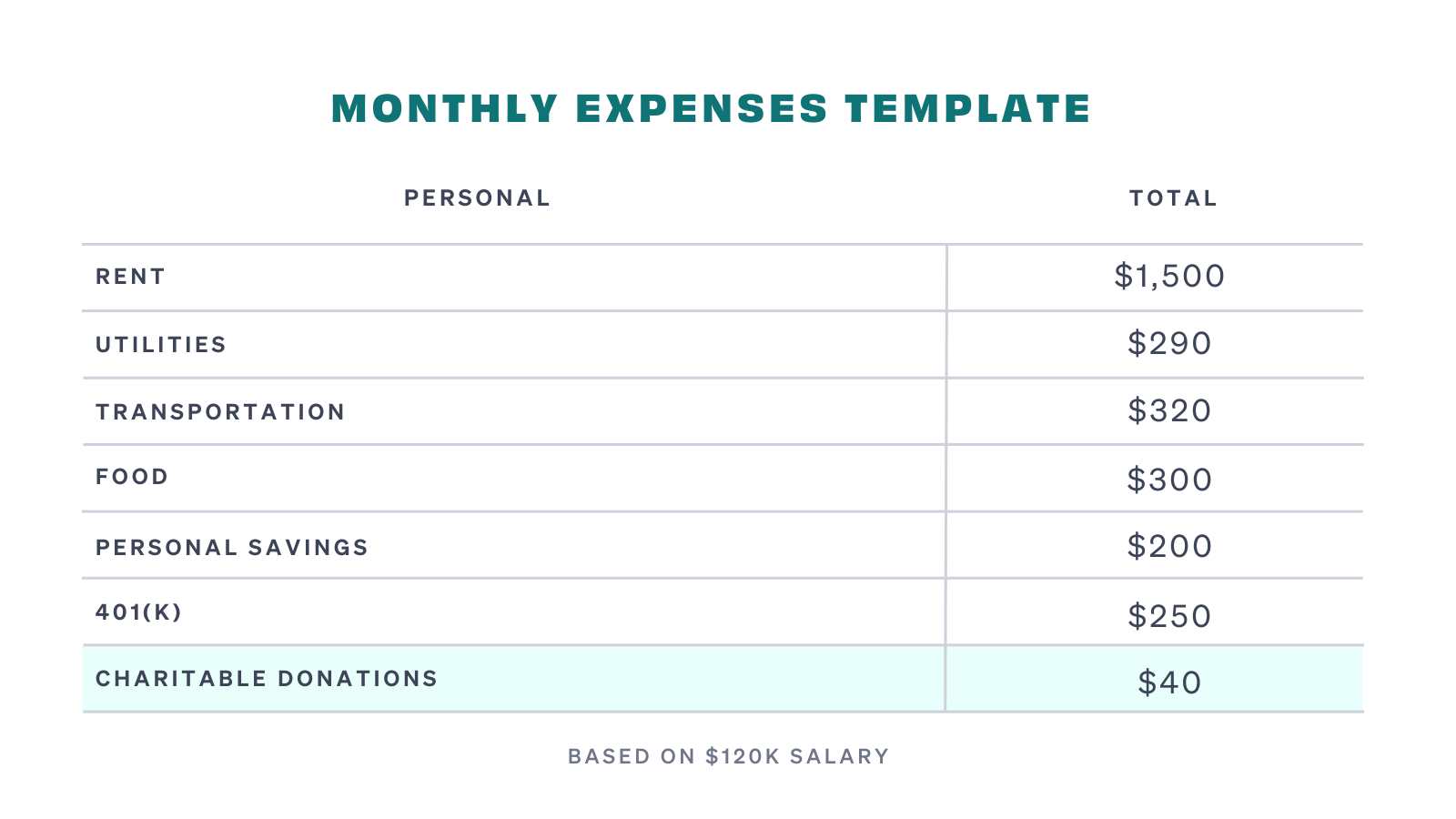

For example, if you're a single individual living in San Jose, CA making $120,000 a year and your take-home pays each month is $2,900, you may decide that due to your current home and retirement saving goals, you want to set aside $40 per month for giving.

2. Donate based on your income

If you want to maintain a consistent level of giving, donating a percentage of your income is a great way to adjust your giving as your financial situation changes over time. For example, if you make $120,000 a year and decide to give 1%, that would mean budgeting for $1,200/year ($100/month).

If you later receive a promotion and your income rises to $130,000, your giving would also increase to $1,300/year ($109/month). We’ve seen our members increase their giving when they get a raise or bonus, or when they get their tax refund.

“I started giving with 10% of my income, but I’ve since bumped it over the years,” Daffy member since April 2022.

Remember, you can always begin with a small amount, such as 0.5%, and increase the amount gradually over time.

“My giving varies by my income. I personally strive for 10% of my income, but giving is highly personal depending on your situation. I would suggest 10% is a nice goal to start with, but for some people, 2% could be good too. Giving is a little addictive. It gets you out of yourself. Giving anything at all is something to pursue,” Daffy member since December 2021.

3. Donate based on your personal or religious values

Many religious people practice tithing, which is the practice of giving a tenth of one's income to support their faith community and to help those in need.

“The way I think about giving is how the Bible explains tithing. Which is you take 10% of your harvest and give back by throwing a big party for the community. Lots of people can benefit from this. Then you live on 90%. I love thinking about giving like throwing a party for my neighbors,” Javen Swanson.

For individuals in the Daffy community, tithing can take different forms, such as giving 10% of their total income, 10% of each paycheck, or using 10% as a starting point.

So if we think back to that single individual living in San Jose, CA making $120,000 a year, using the 10% rule can mean setting aside anywhere from $1,000/month ($12,000/year) or more!

Even if you're not religious, let yourself be inspired by different perspectives on giving. Ultimately, the choice of how to donate should be based on what feels meaningful and important to you.

“My roommate is Muslim and one of the tenants of their religion is to give a certain percentage of your income. I thought, great idea...let me do that,” Daffy member since Dec 2021.

4. Give based on charitable tax deductions

Did you know charitable deductions are one of the most generous income tax deduction strategies? You can deduct up to 30-60% of AGI through charitable donations. And if you want to yield even higher tax savings for you, consider donating appreciated assets, like stock, ETFs, and crypto instead of cash. Why?

- You’ll avoid paying capital gains taxes on the asset.

- You can immediately deduct the full fair-market value of the asset on your federal income tax returns for that year rather than your cost basis.

- Because the organization receiving the asset is a 501(c)(3), they don’t have to pay taxes on liquidating the asset. Meaning, the full amount goes to the organization you care about. It’s actually a win for you and the charity.

Since the majority of non-profits don’t have the capability to receive stock, ETFs, index funds, and cryptocurrencies that’s where donor-advised funds like Daffy come in.

“A donor-advised fund is a great way to make a big donation for tax purposes, spread donations over the year, and give appreciated stock. It’s a nice way to have one transaction with stock and then send cash to charities versus going through brokers,” Daffy member since February 2022.

None of these options is the right or wrong answer on how much you should give to charity.

Just decide how much you can realistically afford to donate, taking into account your personal values, and financial goals, and start small, you can always increase from there. And by incorporating charitable donations into your personal finance spreadsheet or even setting a giving goal, you’ll set yourself up for even bigger success to stay committed.

“Once I was in a position to give, I gave $50 here and there, but I had no idea what a good amount to give was. So some goal is better than no goal and 1% seems like a good and easy goal to keep myself accountable,” Sergei Shevlyagin.

The best way to give to charity is by planning for it, so start today!