Ohio Sickle Cell Health Association Inc.

Ohio Sickle Cell Health Association Inc.

Want to make a donation using Daffy?

Lower your income taxes with a charitable deduction this year when you donate to this non-profit via Daffy.

Do you work for Ohio Sickle Cell Health Association Inc.? Learn more here.

By donating on this page you are making an irrevocable contribution to Daffy Charitable Fund, a 501(c)(3) public charity, and a subsequent donation recommendation to the charity listed above, subject to our Member Agreement. Contributions are generally eligible for a charitable tax-deduction and a yearly consolidated receipt will be provided by Daffy. Processing fees may be applied and will reduce the value available to send to the end charity. The recipient organizations have not provided permission for this listing and have not reviewed the content.

Donations to organizations are distributed as soon as the donation is approved and the funds are available. In the rare event that Daffy is unable to fulfill the donation request to this charity, you will be notified and given the opportunity to choose another charity. This may occur if the charity is unresponsive or if the charity is no longer in good standing with regulatory authorities.

About this organization

Mission

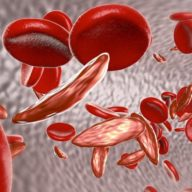

To provide education, advocacy and support statewide to individuals and families affected and at-risk for sickle cell disease

About

Statewide family support through coordinated and collaborated effort of awareness, linkages to support advocacy and education to Ohio's individuals and families at-risk and the professionals who serve them.

Interesting data from their 2020 990 filing

The non-profit's mission, as described in the filing, is “To provide education, advocacy and support statewide to individuals and families affected and at-risk for sickle cell disease”.

When detailing its duties, they were outlined as: “To provide education, advocacy and support statewide to individuals and families affected and at-risk for sickle cell disease”.

- The non-profit has complied with legal regulations by reporting their state of operation as OH.

- The filing shows that the non-profit's address as of 2020 is 341 S Third Street, Columbus, OH, 43215.

- The non-profit's form for the year 2020 reports a total of 3 employees on their payroll.

- Is not a private foundation.

- Expenses are between $100,000 and $250,000.

- Revenue is between $100,000 and $250,000.

- Revenue less expenses is -$13,812.

- The organization has 8 independent voting members.

- The organization was formed in 1979.

- The organization pays $94,399 in salary, compensation, and benefits to its employees.

- The organization pays $0 in fundraising expenses.