In July 2025, Congress passed the One Big Beautiful Bill Act (OBBBA), a sweeping tax reform that changes how charitable tax deductions are treated for millions of Americans. While the bill covered a wide range of policies, charitable donors need to be aware that one small line item is making a big difference in how the IRS recognizes charitable deductions.

It’s all about the 0.5%, the new floor on charitable deductions.

How could half of a percent matter that much?

Welcome to the world of taxes. That small 0.5% change actually means a 25% drop in your tax deduction over the next five years. Fortunately, it turns out that just by having a simple tax-advantaged account for charity called a donor-advised fund (DAF), you can get most of those tax savings back.

Tax Changes that Affect Giving in 2026

The OBBBA introduced several changes to how charitable giving is treated for tax purposes. These changes took effect January 1, 2026. Most of the updates are positive, but the fine print really matters:

- 60% of Adjusted Gross Income (AGI). The existing 60% of AGI limit for deducting cash donations to 501(c)(3) charities, which was scheduled to revert to 50%, is now permanent.

- 35% is the new 37%. For donors in the top tax bracket, charitable deductions are now capped at 35%, meaning that you have to give a bit more to get the same effective deduction benefits on your taxes.

- For corporations: New limits mean companies can only deduct charitable donations between 1% and 10% of taxable income.

- If you don't itemize: You can now deduct $1,000 of charitable cash donations ($2,000 if you're married and filing jointly). Some types of donations are ineligible for the deduction, including to DAFs or private non-operating foundations. This is a new "universal" deduction designed to encourage more people to give.

- If you do itemize: You can only deduct charitable donations that exceed 0.5% of your AGI.

It's that last one that's the easiest to ignore, and yet it may make the biggest difference for generous donors.

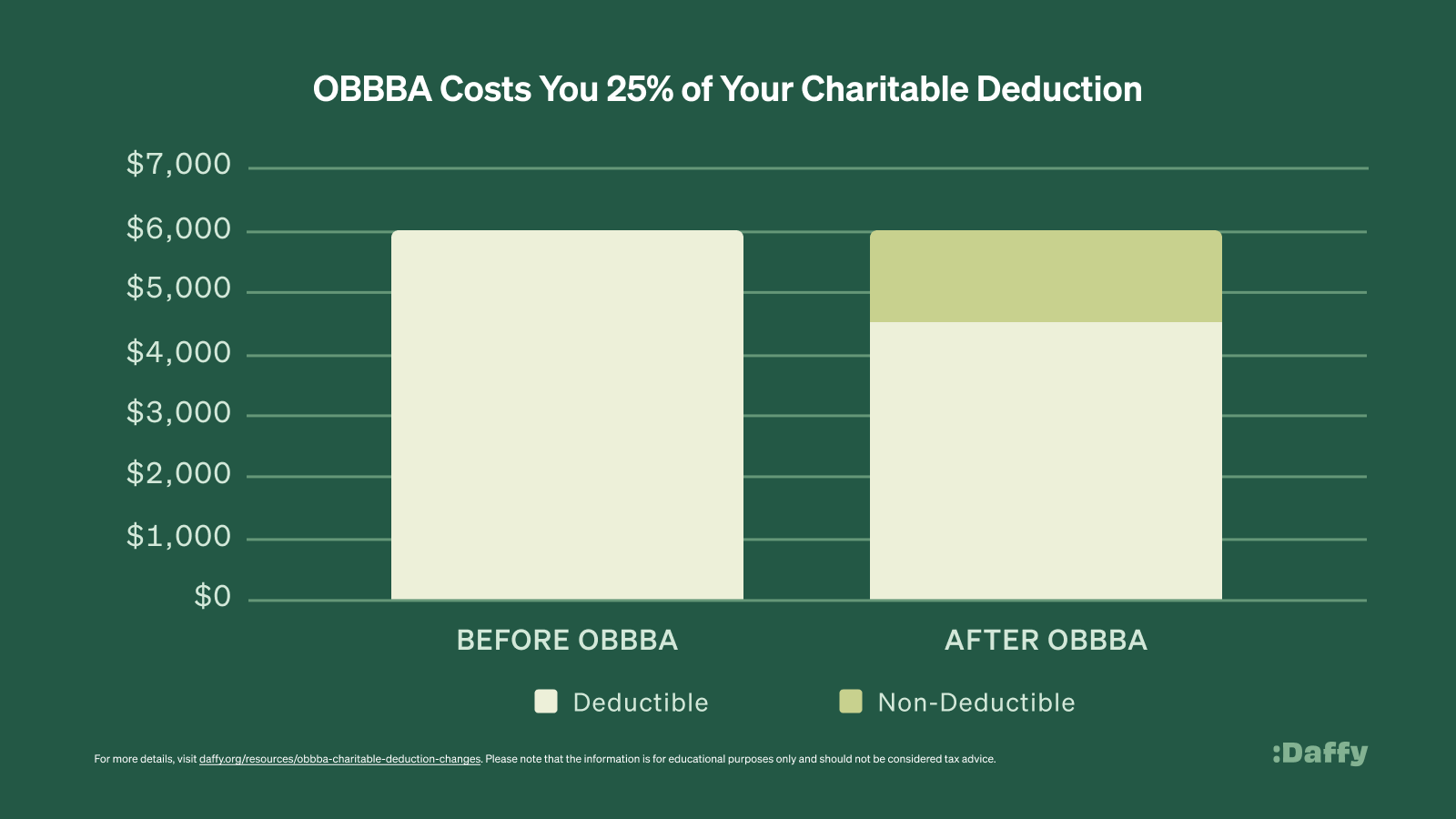

How 0.5% Can Cost You 25% of Your Charitable Tax Deduction

It's not surprising that most analysts have ignored this seemingly small change in the tax code. There have already been dozens of articles about the OBBBA, but few spend much time on this change. But for most households, this could make a big difference on their taxes.

Why? It's simple, really. The average American household gives roughly 2% of their income to charity each year.

So while 0.5% might seem like a small number, it's a full 25% of what the typical household gives. And that means that a household might lose a large portion of their charitable tax deduction every year.

Let's take a sample household, the Steady family. The Steady household does well for themselves, with an AGI of $300,000 per year. Like most households, between schools, religious institutions, and causes, they donate about 2% of their income ($6,000) to charity every year.

Since the Steady family itemizes, they previously were able to deduct $6,000 from their income taxes every year. Now, with the OBBBA changes, they lose 0.5% of their AGI, $1,500, off that deduction.

Over five years, that means the Steady family will only be able to deduct $22,500 from their taxes, instead of $30,000. At a 24% tax rate, instead of saving $7,200 on their taxes, they saved just $5,400. The Steady family will pay $1,800 more on their taxes, a loss of 25% of their charitable tax deduction.

Brutal.

The Donor-Advised Fund to the Rescue

Fortunately, there is a solution that recovers most of these tax savings. It's called a donor-advised fund (DAF), and it's a tax-advantaged account for charity offered by many banks and brokerages. Because DAFs themselves are 501(c)(3) public charities, your contributions are immediately tax-deductible, just like a direct donation to any qualified charity.

A DAF allows you to set aside money, get a charitable tax deduction in the year the contribution is made, and then the money is invested tax-free for as long as needed. Once you want money to be sent to a charity, you make a donation recommendation, and the DAF sends the funds to the charity. DAFs are incredibly popular, and growing quickly, exceeding $326 billion in assets as of 2024.

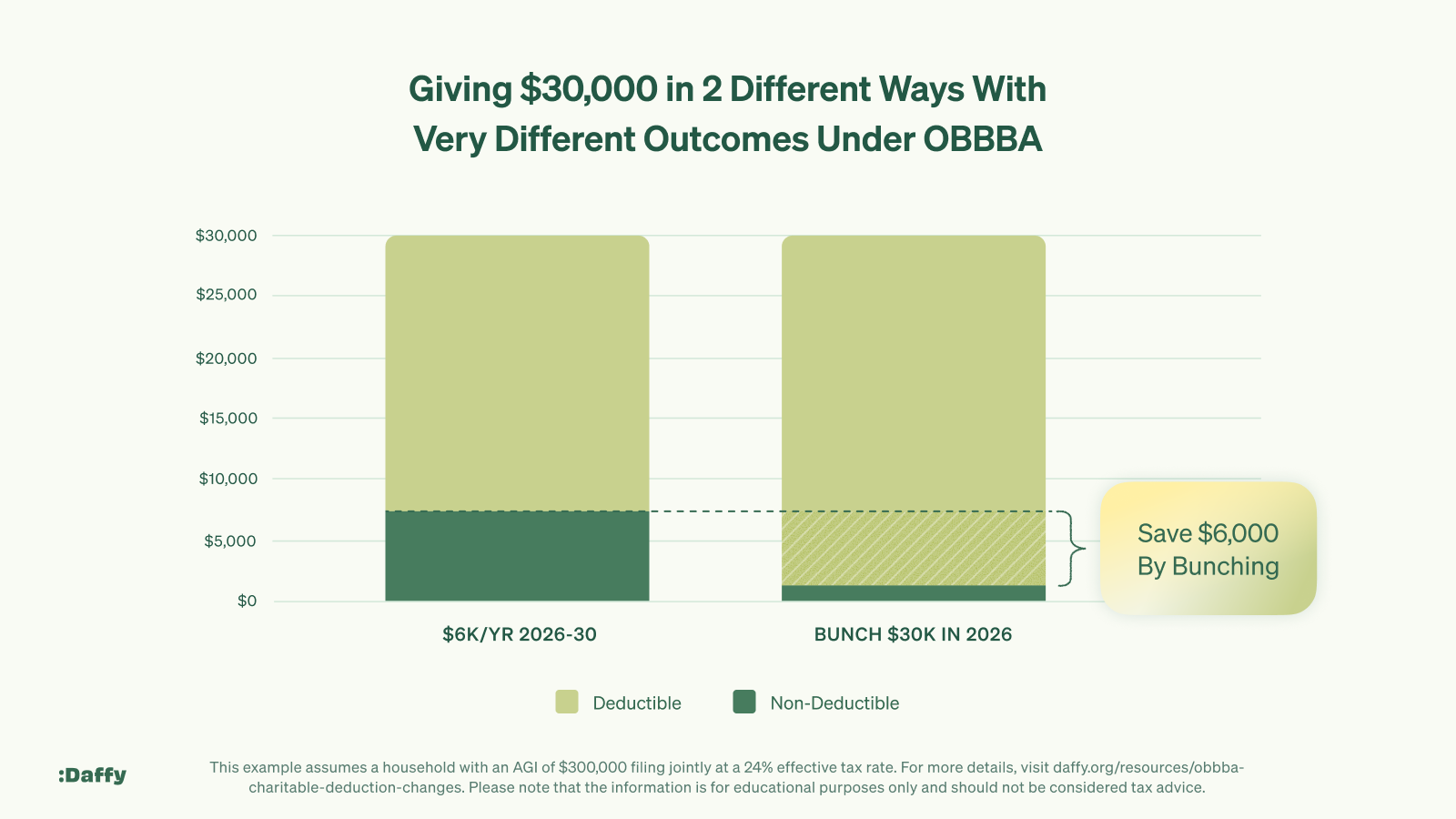

One of the great features of a donor-advised fund is "bunching," the ability to pre-fund your charitable account with multiple years of giving. This turns out to be the key to recovering the tax savings that were cut as part of the OBBBA.

To illustrate, let's look at another sample household, the Bunchy family. While the Bunchy family has the exact same income and annual giving as the Steady family, they use a DAF to manage their giving. Instead of making $6,000 worth of donations every year directly to charities, they contribute five years' worth of giving at a time into their DAF.

As a result, when they contribute $30,000 to their DAF, the 0.5% exclusion is still only 0.5% of their AGI, $1,500. As a result, they get to deduct $28,500 off their taxes for a tax savings of $9,975, more than $2,000 from their taxes versus the Steady family over five years.

The Bunchy family actually has two more advantages over the Steady family:

- Their initial contribution of $30,000 is invested in a diversified portfolio, tax-free, so not only can they give $6,000 every year to the charities they support, they may even earn enough on their account to afford a sixth year of giving!

- The Bunchy family contributes appreciated securities, like stock and ETFs, to fund their DAF. As a result, they never pay the capital gains taxes on those investments.

It may seem obvious, but many households still write checks to charities every year without using a donor-advised fund. Thanks to the OBBBA, that approach to charitable giving may now be thousands of dollars more expensive.

How To Maximize Your Charitable Tax Savings with a DAF

Now that the OBBBA rules are in effect, you have two choices:

- Donate to charity annually over five years, and get to deduct up to 75% of your charitable contributions.

- Donate a lump sum worth five years of giving now, and get to deduct up to 95% of your charitable contributions.

Making the donations in the form of appreciated securities to a DAF is likely the easiest way to achieve the highest charitable tax savings.

It’s Time to Open a Donor-Advised Fund

With services like Daffy, the Donor-Advised Fund for You™, it’s not hard to get started. Opening an account can take less than a minute, and it’s easy to fund the account with cash, stock, ETFs, mutual funds, or even crypto.

If you give to charity regularly, the OBBBA has made it very clear that a portion of your donation will no longer be tax-deductible.

Minimize the impact of that change by bunching if you can. By funding a DAF with appreciated securities like stock, ETFs, mutual funds, or crypto, you can claim a triple tax win:

- Use bunching to minimize the lost deduction.

- Invest your charitable funds tax-free for years.

- Avoid paying capital gains taxes on the shares you donate.

It will mean a lower tax bill for you, and more money to the charitable organizations you care about.

Please note that the information contained on this page is for educational purposes only and should not be considered tax or investment advice. Any calculations are intended to be illustrative and do not reflect all of the potential complexities of individual tax returns. To assess your specific situation, please consult with a tax and/or investment professional.